Cash Reporting: Underwriting Guidelines

Cash transactions must be reported on IRS Form 8300 if all of the following requirements are met:

1. The aggregate amount of cash received is over $10,000 (receipt of exactly $10,000 in cash is not reportable, but receipt of $10,001 is reportable). a. The reportable amount may be received either in one lump sum of cash (or cash equivalent) in excess of $10,000; or b. In installment payments that cause the total cash (or cash equivalent) received within one (1) year of the initial payment to total more than $10,000.

2. Received in the course of your trade or business;

3. Received from the same buyer (or the buyer’s agent); and

4. Received in a single transaction or in two or more related transactions:

a. Any transactions involving the same buyer (or an agent for this buyer) that occur within a 24- hour period are called “related transactions”;

b. If over $10,000 in cash is received from the same buyer in two or more transactions occurring within a 24-hour period, you must treat the transactions as one and report the cash payments on Form 8300.

Watch out for “structuring” or suspicious transactions. Should a purchaser come to closing with two cashier’s checks from two different financial institutions – each one less than $10,000 – with a combined aggregate total of more than $10,000, the purchaser may be trying to avoid cash reporting requirements. If the closing agent accepts checks under these circumstances, the agent may be found guilty of assisting in the structuring of the sale transaction, and be criminally prosecuted.

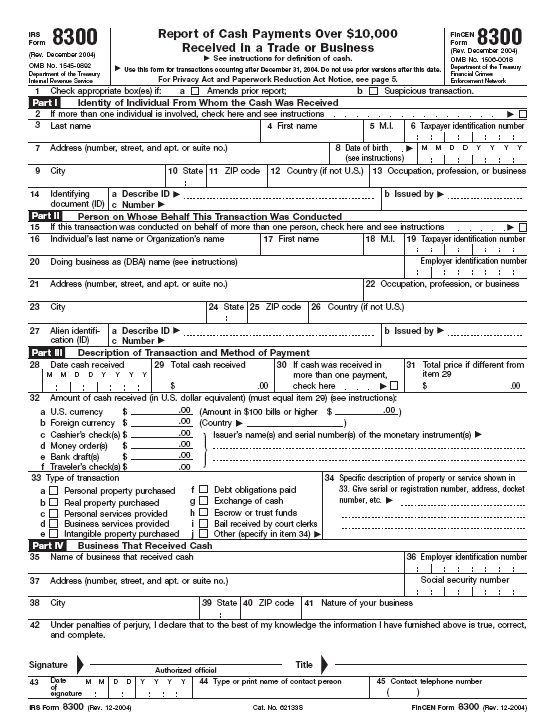

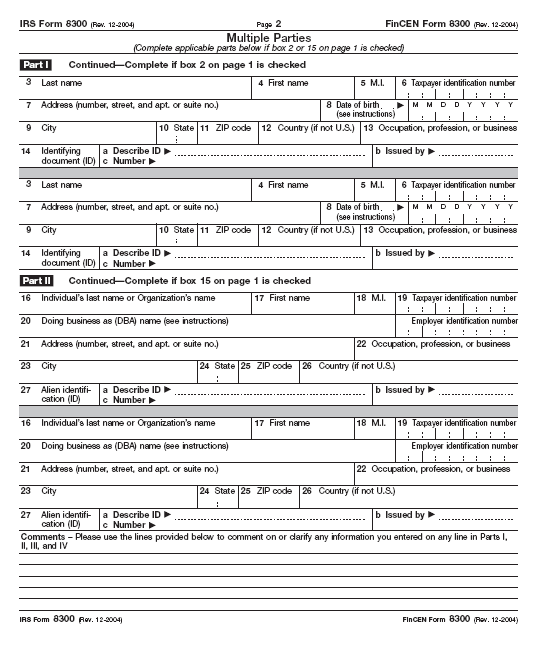

Sample of IRS Form 8300, Rev 12/2004

To view or print the entire document please go to http://www.irs.gov/pub/irs-pdf/f8300.pdf

The IRS also requires the agent to report any transactions which appear to be suspicious or give signs of possible illegal activity even if no report would otherwise be required. Although no specific standards have been published by the IRS to define the obligation of a closing agent to uncover illegal activity, the agent should be careful to use common sense.

Apparent attempts to evade the cash reporting requirements should be avoided by filing Form 8300 to the IRS even if it is not otherwise required. Also, avoid counseling or advising customers of ways to circumvent the reporting requirements. Cash purchasers may still be advised to obtain a cashier’s check or money order for closing purposes, but advice should not be given as to means of avoiding the cash reporting requirements. Form 8300 may be obtained from your local IRS office or call to order the form at 1-800-TAX-FORM (800-829-3676).